Vietnam has become a heated investment destination in Southeast Asia following the US-China Trade war, recent supply chain disruptions due to COVID-19, and many large international companies are seeking manufacturing diversification opportunities.

Vietnam is known for its low costs and improving manufacturing capabilities. However, there is a lot to improve in terms of infrastructure, manufacturing ecosystem, efficiency, and transparency. In recent years, Apple and SamSung have expanded their manufacturing bases in Vietnam, but is it easy to find contract manufacturing in Vietnam?

In this article, we’ll review Vietnam’s contract manufacturing locations, industries, advantages and disadvantages of finding contract manufacturing in Vietnam.

Table of Contents

- Contract Manufacturing Locations in Vietnam

- Contract Manufacturing Sectors in Vietnam

- Advantages of Contract Manufacturing in Vietnam

- Disadvantages of Contract Manufacturing in Vietnam

Contract Manufacturing Locations in Vietnam

Most of the contract manufacturing in Vietnam can be found either in or neighbouring the cities of Hanoi and Ho Chi Minh.

North

The northern region is the primary manufacturing location for electronics, tech products, telecommunication equipment, etc.

Bordering China with convenience to import raw materials and components, Hanoi and its neighbouring cities and provinces like Bac Giang, Thai Nguyen, Bac Ninh, and Hai Phong are some of the fastest-growing regions that foreign companies target when relocating or expanding their electronics manufacturing to Vietnam, setting up factories in Hai Phong or other northern provinces. .

The northern parts of Vietnam have a comparatively developed road network, even stretching all the way to Shenzhen, known as the electronics heaven in China.

South

As the economic center and the capital, Ho Chi Minh and its neighbouring cities and provinces like Binh Duong, Long An, and Dong Nai are crucial for textile, clothing, and furniture manufacturing.

Central

Da Nang is a second to none choice for contract manufacturing in Central Vietnam. As the fifth biggest city in Vietnam and the gateway to the central region, Da Nang has quickly industrialized. The city has changed dramatically in recent years, thanks to a more sustainable approach to urban development. This has allowed the city to sustain economic growth while also maintaining its status as the country’s “most liveable city”. This city is expected to be the most advantageous location in Central Vietnam for manufacturing, although it is still far less appealing than the two most well-known cities in Vietnam, Hanoi, and Ho Chi Minh City. This is owing to several difficulties for contract manufacturing in Da Nang, notably the lack of a major port.

Contract Manufacturing Sectors in Vietnam

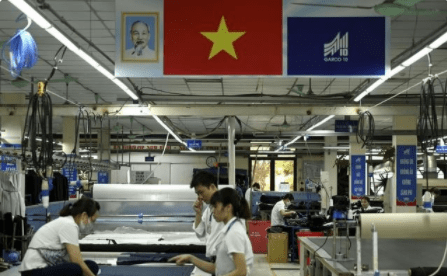

Apparel and Textile

The textile sector is Vietnam’s second largest in terms of export revenue. Vietnam has long been a large exporter of garments and textiles, with a robust manufacturing base of over 6,000 textile businesses employing millions of people. The industry grew a lot in the late 1990s, and nowadays many multinational apparel companies have a manufacturing presence in Vietnam.

As to the supply base, 70% of the factories are in or near Hanoi and Ho Chi Minh City, where the sector began to expand.

Electronics

The electronics industry accounts for a sizable portion of Vietnam’s manufacturing output and exports. In recent years, foreign direct investment capital is increasingly shifting to electronics manufacturing in Vietnam.

With multinationals such as Samsung, Foxconn, and Intel present, Vietnam has risen to the top of the electronics manufacturing world in terms of export value during the last decade. Most electronic goods are produced in the North (Bac Ninh, Bac Giang, and Hai Phong provinces) as they may employ components from neighboring areas.

Notwithstanding, Vietnam is well-known for its strong capability in midstream activities. Meanwhile, upstream activities, involving the design and production of sub-components, and downstream activities, involving sales and distribution, are primarily done overseas. Local companies concentrate more on the assembly of finished products and sub-assemblies for export.

Advantages of Contract Manufacturing in Vietnam

Cost-Efficient and Plentiful Workforce

Vietnam has some of the lowest labor costs in Southeast Asia after Indonesia and Cambodia, and the labor costs in Vietnam are typically one-third to one-half of those in China. Furthermore, Vietnam’s labor force is large, as the proportion of the Vietnamese population of working age is almost consistently greater than 50%.

Free Trade Agreements

Vietnam has various Trade Agreements (FTAs) with different countries, including the EU (EVFTA) and the UK (UK-Vietnam Free Trade Agreement), with the EU ultimately removing 99.2% of all tariffs after 7 years from the entry into force.

Government Incentives

For more than two decades, the Vietnamese government had a strong focus on economic growth and development. Thanks to policy changes and the easing of foreign investment restrictions, the country has become more favorable to establishing production in recent years.

Disadvantages of Contract Manufacturing in Vietnam

Less Skilled Workforce

Although the Vietnamese workforce is abundant at a reasonable cost, it is not as skilled compared to China’s on average, for example. This is particularly the case in advanced manufacturing.

Higher MOQ

Minimum order quantities (MOQs) are typically higher in Vietnam although this varies based on industries and specific products.

Lack of Price Competition

Generally, price competition in Vietnam manufacturing can be difficult and frustrating, and there is little opportunity to haggle for the most affordable prices. The first reason is that Vietnam is home to fewer factories than countries like China.

The second reason is that a substantial number of foreign suppliers have extensive knowledge, depreciated equipment and machinery, and modern production networks with low-cost, high output. At the same time, many domestic firms have inefficient production methods and poor administration, resulting in a low level of price competition.

Rely Heavily on Imports from China

Vietnam continues to import a substantial number of raw materials from China. Furthermore, Vietnam is heavily reliant on imports of intermediate goods from China, which also results in other manufacturing-related concerns including longer production lead times and higher logistics costs.